Frequently Asked Questions

What does the assessor do? What the assessor does not do? How is property valued? How are taxes calculated? Can I get a survey or copy of my deed at the assessor's office? If I own undivided interest in property but have been paying all the property taxes for several years, do I own the property now? How is agriculture land assessed? How long is my homestead effective? How do my taxes increase? What if I disagree with the assessor's value of my property? What if I don't receive my tax notice?What does the assessor do?

The assessor is responsible for identifying, listing, and fairly valuing all property subject to ad valorem taxation on an assessment roll each year. Property consists of all real estate (land and buildings) as well as personal property (inventory, furniture/fixtures, machinery/equipment, and oil/gas wells). Ad valorem taxation means that property should be taxed "according to value." The value determined by the assessor is called “assessed value” and is a percentage of fair market value (FMV) or use value as prescribed by law. The "market value" of real property is based on the current real estate market. Finding the "market value" of your property means discovering the price most people would pay for your property in its current condition. Determining a fair and equitable value is the only role of this office in the taxing process.

The Avoyelles Parish Assessor's Office is responsible for keeping an accurate inventory of approximately 35,000 parcels of property. This process includes maintaining current ownership records, addresses, legal descriptions, property maps, sales information, soil classification, and appraisal data such as pictures and sketches of buildings

Back to TopWhat the assessor does not do?

The assessor does not raise or lower taxes. The assessor's primary responsibility is to determine the "fair market value" of your property so that you pay only your fair share of the taxes. The amount of taxes you pay is determined by the "millage rate", which is applied to your property's assessed value. The millage rate, as voted by the public, is levied by all the taxing agencies within the district, city, or parish, and those rates fixed by the Constitution. This includes school districts, police juries, law enforcement districts, etc. The millage rate is the basis for the budget needed or demanded by the voters to provide for services such as schools, roads, law enforcement, etc. The tax dollars are collected by the Sheriff's Office as Ex-Officio Tax Collector.

The assessor does not make the laws which affect property owners. The Constitution of the State of Louisiana, as adopted by the voters, provides the basic framework for taxation, and tax laws are made by the Louisiana Legislature. The rules and regulations for assessment are set by the Louisiana Tax Commission.

The assessor does not create value. Value is created by consumers buying and selling real estate in the marketplace. The assessor has the legal responsibility to study those transactions and appraise your property accordingly.

Back to TopHow is property valued?

Louisiana law requires that properties be reassessed once every four years. However, individual property values may be adjusted between that period in light of sales activity or other factors affecting real estate values in your neighborhood. Sales of similar properties are a strong indicator of values in the real estate market in your vicinity.

To find the value of your property, the assessor must first know what properties have sold, and how much they are selling for in today’s market. Each transaction must be studied to make sure it was an arms-length transaction, meaning that a willing seller sold to a willing buyer without any undue pressure or special incentives (such as family relationship), and that the property was on the market for neither an excessive nor short period of time. Once this is determined, we can base the value of a property from other sales of comparable properties. This is the sales comparison approach to valuation.

Two other methods are used to appraise property, the cost approach and the income approach. The cost approach is based on how much it would cost today to build an almost identical structure on the parcel. If your property is not new, the assessor must also determine how much the building has lost value over time. The assessor must also determine the value of the land itself, without any buildings or improvements.

The income approach is the third way to evaluate property, typically commercial property. It requires a study of how much revenue your property would produce if it were rented as an apartment house, a store, an office building and so on. The assessor must consider operating expenses, taxes, insurance, maintenance cost, and the return or profit most people would expect on your kind of property.

Back to TopHow are my taxes calculated?

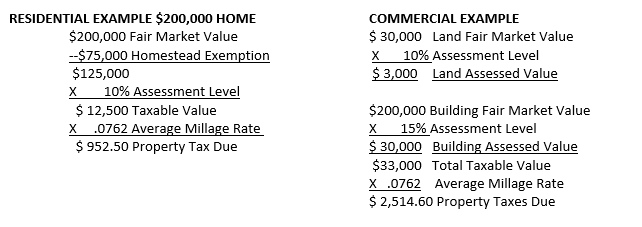

Taxes are calculated by multiplying the assessed value by the tax rate set by millages, bond issues, and fees voted on by registered voters in various districts or which have been established by the Legislature or Constitution. If the property is your primary residence, you may deduct the first $75,000 of market value from the total maket value, providing you are eligible and have applied for homestead exemption. Municipal taxes are in addition to parish taxes and are not subject to homestead exemption. Below are examples of tax calculations:

Can I get a survey or copy of my deed at the assessor's office?

The Avoyelles Parish Clerk of Court is the official record keeper of the parish including deeds and plats. Our office can provide you with the latest conveyance number of your property which will allow the Clerk of Court to access your records in timely fashion without having to run indexes. The Assessor’s Office can also provide you with a GIS property map of your parcel.

Back to TopIf I own undivided interest in property but have been paying all the property taxes for several years, do I own the property now?

The Avoyelles Parish Tax Collector (Avoyelles Parish Sheriff) mails one bill for each assessment, therefore multiple owners of a property must decide between each other how the taxes will be paid. If only one party pays the notice, that party does NOT gain any additional ownership or rights to the property.

Back to TopHow is agriculture land assessed?

Agriculture, horticultural, or timber land which is at least 3 acres in size may qualify for use value assessment. Use value rates are adopted by the Louisiana Tax Commission. The assessed value rates for use value properties depending on soil classification vary from $7.50 to $39.77 per acre. Based upon the average parish millage, this correlates to property taxes of $.53 to $2.82 per acre.

Back to TopHow long is my homestead effective?

You must apply for homestead exemption and then it is determined if you are eligible. Once granted, it is in effect permanant, as long as you own and reside at that location.

Back to TopHow do my taxes increase?

When additional taxes are voted by the people, an individual's property tax bill will increase.

When market value increases, so does the assessed value. Buyers and sellers set value by their transactions in the marketplace.

If you were to make improvements to your existing property, for instance, add a garage, additional room, shed, or outdoor kitchen, the "fair market value" increases, and therefore, the assessed value would also increase.

Back to TopImportant Dates:

August 15 thru September 15 (Assessment review period)

December 31 (Tax payments due)

What If I Disagree With The Assessor's Value Of My Property?

As a taxpayer, you have a certain legal responsibility to furnish accurate information on your property to the assessor’s office. If you have complied with these legal requirements, you are entitled to question the value placed on your property. Each year during the last part of August and the first of September the assessment rolls are open for inspection and for discussion of the assessment with the assessor’s office. If your opinion of the value of your property differs from the assessor’s, this is the time to discuss your assessment. Be prepared to show evidence that the assessor’s valuation of the property is incorrect. Our staff will be glad to answer your questions about the assessor’s appraisal, explaining how it was done. If after discussing the matter with the assessor, a difference of opinion still exists, you may appeal your assessment to the Avoyelles Parish Board of Review according to procedures. After reviewing your appeal, if the Board agrees with the assessor and a difference of opinion still exists, you may appeal the Board’s decision to the Louisiana Tax Commission. If the Commission agrees with the Board and the assessor, you can plea your case before the courts should you choose to do so.

Back to TopWhat If I Don't Receive My Tax Notice?

Even if you do not receive a tax notice, it is your responsibility to be sure that the property taxes have been paid. You may contact the tax collector, the Avoyelles Parish Sheriff’s Office, to determine the amount of property taxes owed and whether or not the taxes have been paid.

Parish Property Taxes:

Avoyelles Parish Tax Collector (Sheriff's Office)

675 Government St

Marksville, LA 71351

(318) 253-4000 option 4 or http://snstaxpayments.com/avoyelles