The Avoyelles Parish Assessor's Office is responsible for identifying, listing, and fairly valuing all property subject to ad valorem taxation within the parish. Property consists of all real estate (land and buildings) as well as personal property (inventory, furniture/fixtures, machinery/equipment, and oil/gas wells). This process is governed by the Louisiana Constitution, laws enacted by the Louisiana Legislature, and rules and regulations of the Louisiana Tax Commission.

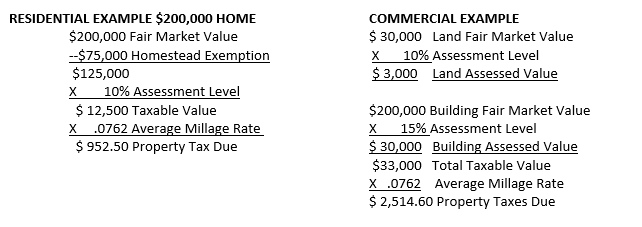

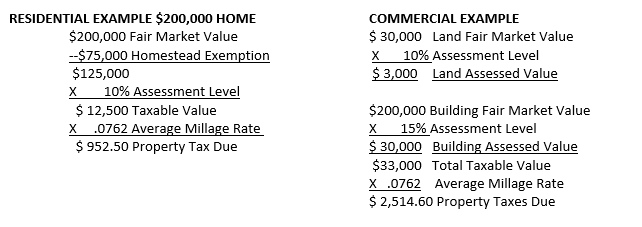

Ad valorem taxation means that property should be taxed “according to value.” The value determined by the assessor is called “assessed value” and is a percentage of fair market value (FMV) or use value as prescribed by law. Assessed value is determined as follows:

Taxes are calculated by multiplying the assessed value by the tax rate set by millages, bond issues, and fees voted on by registered voters in various districts or which have been established by the Legislature or Constitution. If the property is your primary residence, you may deduct the first $75,000 of market value from the total maket value, providing you are eligible and have applied for homestead exemption. Municipal taxes are in addition to parish taxes and are not subject to homestead exemption. Below are examples of tax calculations:

The Avoyelles Parish Sheriff's Office is responsible for mailing the tax notices and collecting the taxes based on the assessments and the millage rates. The tax notices are sent out in the latter part of the year and are due by December 31.

Municipal taxes for Bunkie, Cottonport, Mansura , Marksville, Moreauville, and Plaucheville are included in the parish tax notices and are collected by the Avoyelles Parish Sheriff's Office. All other municipalities within the parish collect their respective taxes.

The tax monies collected for the district pay for schools, drainage, libraries, law enforcement, the health department, and other services that the taxpayers demand and desire from local government. The various governing bodies within the parish and each municipality adopt their respective millage rates annually. Depending on the location of the property, individual millages may be levied such as Fire Districts, Hospital Districts, Road Districts, Levee Districts, and Water Districts.